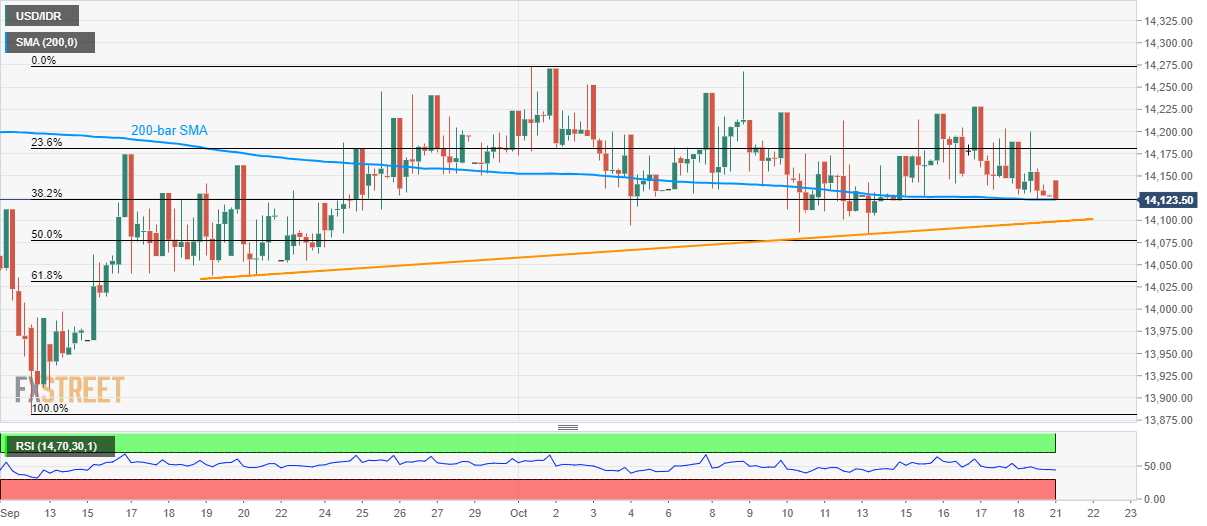

USD/IDR technical analysis: 14,120 holds the key to a month-old rising trendline

- USD/IDR nears 200-bar SMA, 38.2% Fibonacci retracement confluence.

- An upward sloping trend-line since September 20 adds to the supports.

- The last week’s top acts as immediate resistance to watch.

Although gradual weakness from last week’s top drags the USD/IDR pair to a week’s bottom, the quote stays above near-term key support confluence while trading around 14,125 during early Monday.

38.2% Fibonacci retracement of mid-September to early October run-up joins 200-bar Simple Moving Average (SMA) while offering the key support confluence near 14,120. Should sellers dominate below that, a four-week-old rising trend-line, at 14,100, will be important to watch.

In a case where prices keep declining below 14,100, 61.8% Fibonacci retracement level of 14,030 and 14,000 will flash on bears’ radar.

Alternatively, pair’s rise above last week’s high nearing 14,230 can escalate the recovery towards 14,270/75 area that includes the monthly top.

USD/IDR 4-hour chart

Trend: sideways