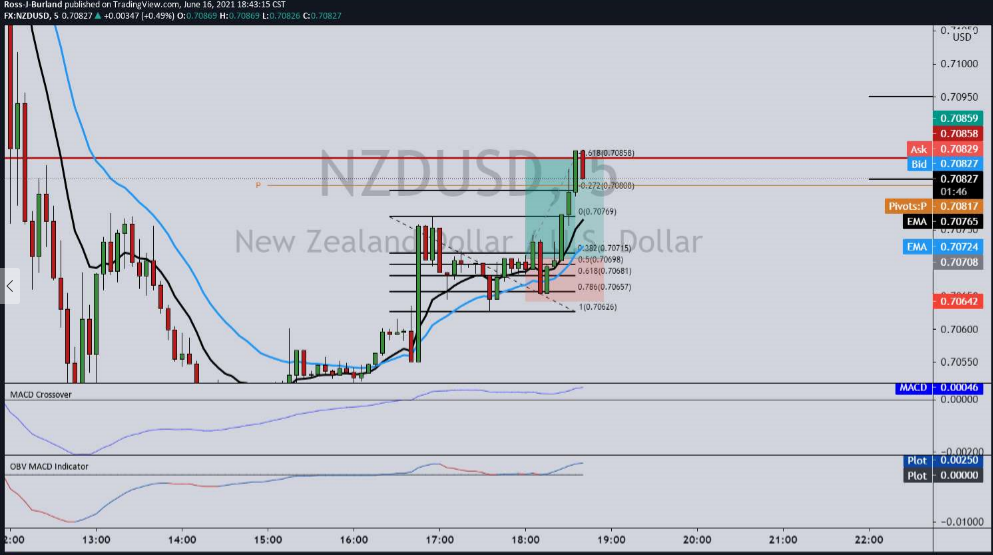

NZD/USD Price Analysis: Traders skinning the cat (bird)

- NZD/USD is choppy in the correction and has offered opportunities both ways.

- Bears looking for a discount, but bulls staying in control.

As per the prior analysis, NZD/USD Price Analysis: Bulls look for correction, but GDP slated, the bulls have indeed corrected the knee jerk sell-off.

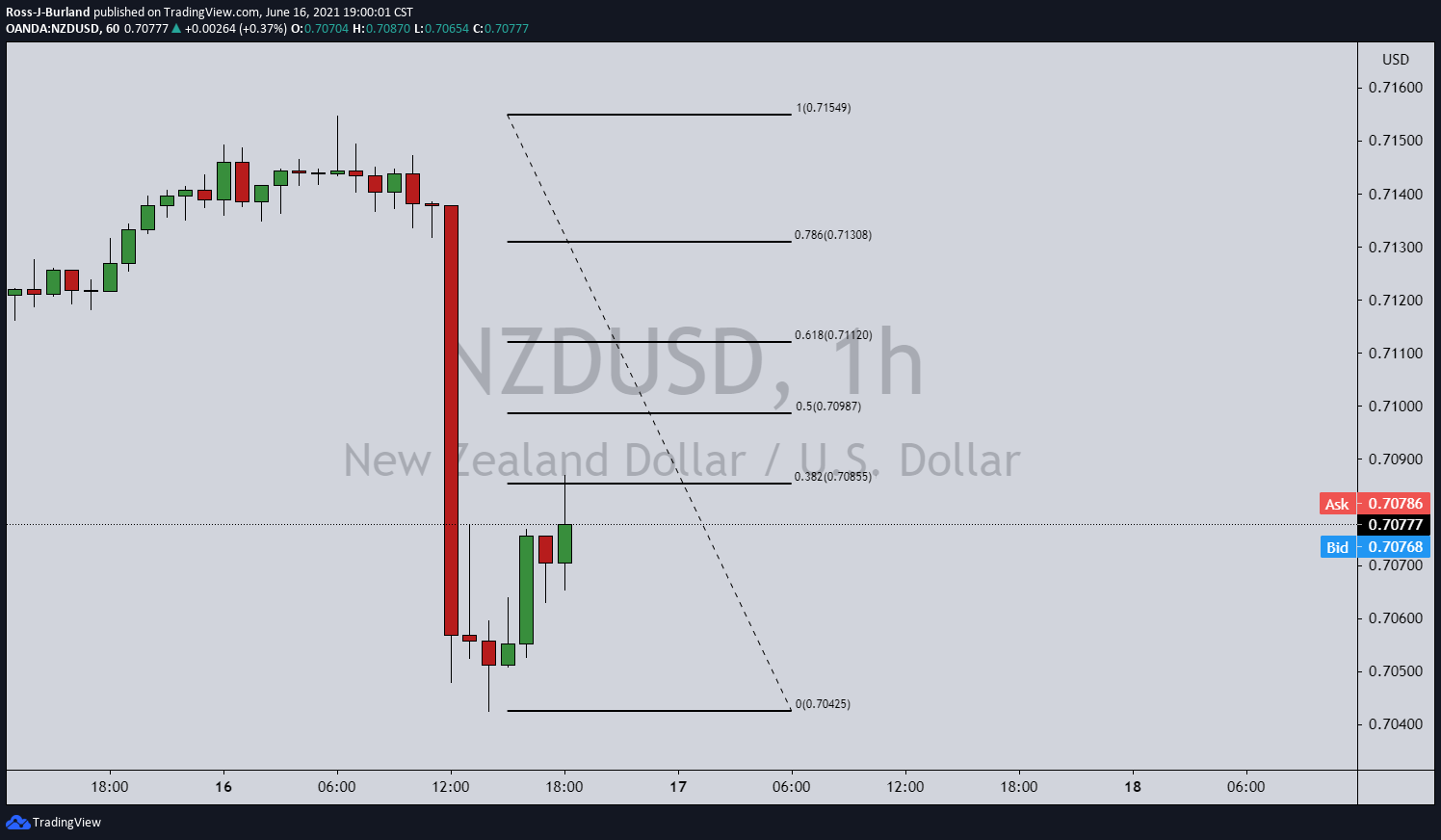

Prior analysis

''There is every likelihood that a 38.2% Fibo retracement could be realised in the forthcoming sessions, but the New Zealand Gross Domestic product will be important for the kiwi.

A current 38.2% Fibo arrives in the 0.7080s.''

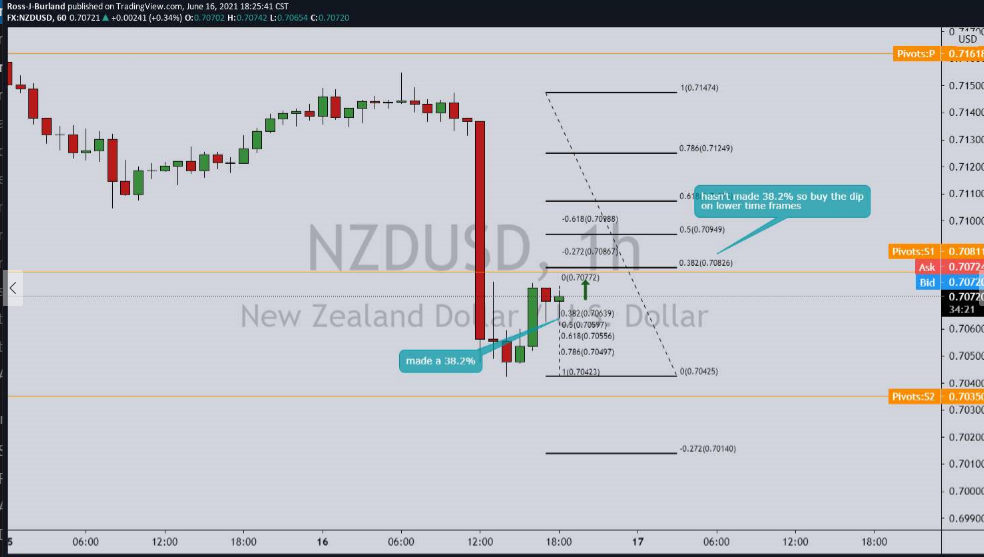

Live markets, hourly chart

As illustrated, the price has indeed corrected to the said target.

In doing so, there were a number of opportunities on the way there, and indeed, ''there's more than one way to skin a cat.''

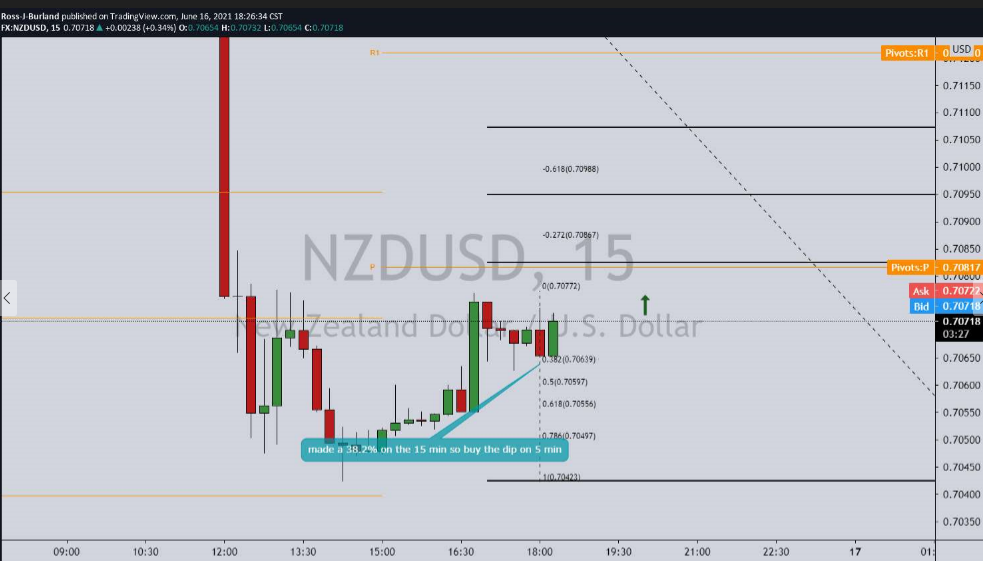

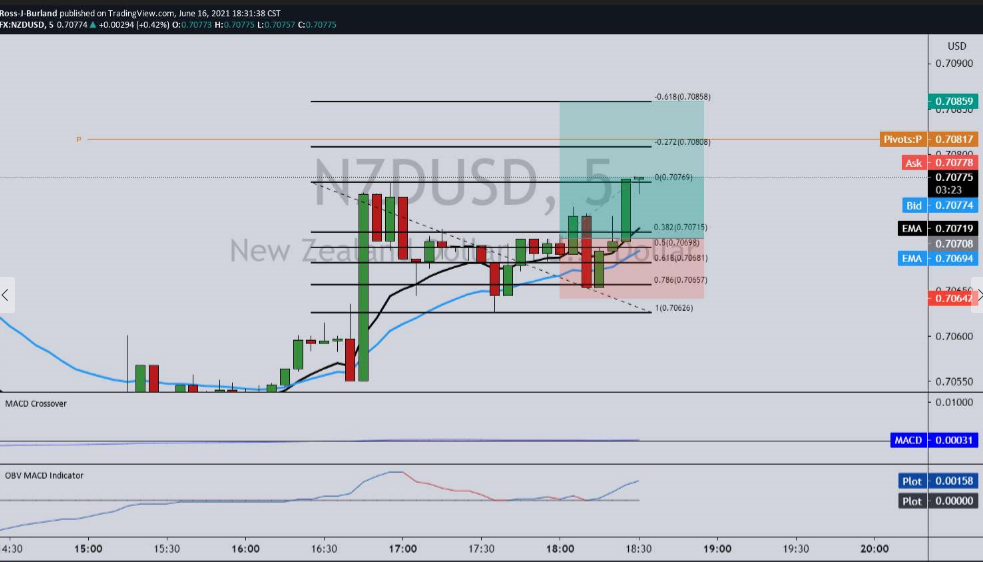

On the lower time frames, such as a combination of the 15 and 5 min chart, an opportunity presented itself as follows:

Meanwhile, until the markets firmer on direction, there are arguments either way which should lead to some volatility over the coming sessions.

This opens prospects of a downside extension once the correction has run out of juice.

Therefore, bears could be looking for a discount at this juncture: